The simple answer to the question “Is Cataract Surgery Covered by Medical Insurance” would be yes, it indeed is! Most health insurance plans are generous enough to recognize cataract surgery as a necessary procedure that requires coverage. However, it all entirely depends on your insurance plans and policies and your expectations from the same.

Are you someone who’s been struggling to look for answers but does not know which resources to check? This blog is the right place to get all your answers in the simplest way possible!

Table of Contents

How Much Does Cataract Surgery Cost in India?

Alt Text: Is Cataract Surgery Covered by Medical Insurance

If you’re considering cataract surgery, understanding the costs associated with it is crucial. In India, the cost depends on various factors like the type of procedure, the kind of intraocular lens you want, the healthcare facility and so on.

In India, cataracts are mostly found among middle-aged people, i.e., ages 50 and above. The cost that is concerned with the surgery can start from as little as Rs.15,000 and go beyond Rs.1,00,000.

Here’s a quick breakdown of the costs that you are likely to incur in India:

1. Phacoemulsification Cataract Surgery:

Phacoemulsification Cataract Surgery is the most common procedure compared to other types. It involves using ultrasound energy to melt the cloudy lens through a small incision. The cost of this procedure starts from Rs. 22,000 and can go up to 60,000 or more.

2. Extracapsular ( Manual )Cataract Surgery ( SICS / MSCIS):

This procedure involves removing the cloudy lens with the lens capsule being left behind. The cost of this surgery is either Rs 15,000 or more, per eye.

3. Bladeless Cataract Surgery:

This is the latest and more advanced procedure that involves no incisions, making it more expensive than other procedures. The cost of this procedure ranges from Rs. 80,000 to Rs. 1,20,000 per eye.

However, the costs associated with each type may differ on the basis of the city you live in and the hospital where you will be treated.

Read more: 7 Warning Signs of Cataracts

What’s the Waiting Period In Cataract Surgeries?

Every insurance policy comes with a waiting period. The good news is that you are eligible to claim the insurance after serving your waiting period. However, the bad news is that if you need surgery within the waiting period, you cannot claim insurance.

Most health insurance companies have a waiting period of 1 – 2 years for cataract treatments. But it’s important to check with your insurer or check the policy details on purchasing the policy.

Other Factors to Consider While Purchasing Insurance:

Alt Text: Is Cataract Surgery Covered by Medical Insurance

Besides the waiting period, it’s important to consider various other factors to ensure you get the best coverage for your needs.

Here’s all you need to know to avoid surprises when it comes to making a claim for cataracts:

1. Coverage Details:

Look at what is specifically covered under the policy. This includes surgery, consultations, pre and post-operative care and medication requirements, too.

2. Exclusions:

Be mindful and make sure to check for any exclusions related to the treatment, so that it doesn’t alarm you later

3. Premium Costs:

To be sure whether you will be getting good value for money, it’s crucial to compare the premium costs with the coverage

4. Network Hospitals:

It’s advisable to check whether your preferred hospitals and doctors are within the insurance provider’s network so that cashless payment options are made possible.

5. Co-payment and Deductibles:

To avoid further surprises, always make it a point to understand any co-payment or deductible amounts that require you to pay from your own pocket beforehand.

6. Claim Limit:

Some insurance companies have a set limit for cataract treatments and other treatments alike. Ensure to check whether the policy you’re going for has any limit that may not meet your expectations.

For more information regarding cataract surgeries, check out this blog : The Gap Between Cataract Surgeries for Each Eye

Benefits of Health Insurance Covering Cataract Surgery

Health insurance plans come bearing multiple benefits that can make your cataract surgery journey much less of a burden.

1. Cost Coverage:

Health insurance is a great financial tool that can offset expenses ranging from Rs.10,000 to Rs. 1,00,000 per eye. In bigger cities, the cost of this procedure can get higher.

2. Financial Protection:

Elderly parents hugely benefit from insurance as it ensures affordability by covering charges like daycare treatment and post-surgery costs as policy terms.

3. Savings Opportunity:

Certain insurance plans tailor-made for cataract surgery can be such that your overall medical expenses get covered.

Treat Your Vision the Financially Healthy Way with Prasad Netralaya’s Experts

Having health insurance cuts down the heavy costs of cataract surgery, reducing your financial burden and hence, can help save up for more sacred things waiting to be ticked off in your bucket list. However, it’s essential to first evaluate your insurance policy to ensure it aligns with your requirements.

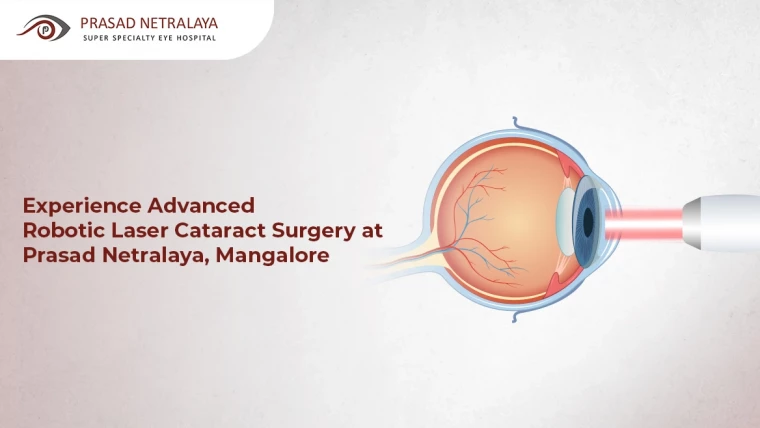

Seeking cataract surgery treatment in Mangalore? Prasad Netralaya Hospital is a choice you must consider. From experienced cataract surgeons to high-end facilities, we have it all. Our team will not only assist you with health insurance requirements but also assure you a seamless experience, throughout.

Schedule an appointment today or visit Prasad Netralaya Hospital and ensure your vision and financial health are in safe hands.

FAQs (Frequently Asked Questions):

1. Is it possible to claim medical insurance for cataract surgery?

Yes, many health insurance policies in India cover the cost of cataract surgeries as mentioned in the above blog. However, they often possess a claim limit and a waiting period, besides other specifications. It’s important to examine the policy documents thoroughly before deciding to buy it.

2. Does insurance cover the payment for cataract lens?

Insurance often covers the basic cost of the cataract lens, but coverage for premium quality lenses may vary depending on the policy you’ve chosen. If you’re unsure whether it’s covered under the policy, check with your insurance provider for the information.

3. Is cataract surgery 100% safe?

Cataract surgery is a safe and routine procedure. Complications during and after the surgery are rare, especially when performed by an experienced surgeon.

Dr. Vikram Jain, M.S. had his medical training (MBBS) from Kasturba Medical College, Mangalore, India. He did his master’s in Ophthalmic surgery from Kasturba Medical College, Manipal. He currently manages the Glaucoma department of Prasad Netralaya hospital.